Model Description

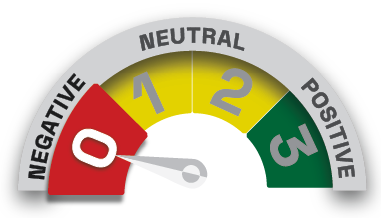

The Harmony Model uses a quantitative analysis-based identification of the current Market Condition: Positive, Neutral or Negative.

Pre-selected model choices are then automatically applied to each Market Condition, reflecting escalating levels of market exposure - below shows level 1.

The Market Condition is determined by the number of the timeframe indicators that are positive. The three timeframe indicators are the STARFLUX, GALACTIC SHIELD, and DELTA-V indicators. When all 3 are positive, the Market Condition is Positive, when all 3 are negative, the Market Condition is Negative, and when there is a mixture of positive and negative, the Market Condition is Neutral.

Construction

The Harmony Model will always consist of the investment tactics most appropriate for each Market Condition.

See the other individual models' pages for details on their composition and rules for movement.

WHEN HARMONY 1 IS IN A POSITIVE POSITION - FOLLOWS BUY/REPACE MODEL

None unscheduled — continuously invested.

Continuously invested through both Bull and Bear Markets. Use for that portion of portfolios intended to be constantly invested. Seeks to achieve outperformance from portfolio selection.

WHEN HARMONY 1 IS IN EITHER NEUTRAL OR NEGATIVE POSITION - FOLLOWS OPTIMUM BOND MODEL

Unscheduled activity occurs when model indicators change to or from "both positive" condition.

Averages 3-4 per year.

When both the DELTA-V and the STARPATH indicators are Positive.

When either the DELTA-V or the STARPATH indicator is Negative.

Corporate Bond investment is by default 50% in Investment-Grade Corporate Bonds and 50% in High-Yield Corporate Bonds.

When out of market, the model is invested 100% in government bonds.

The performance returns illustrated do not represent actual client accounts and are net of the highest management fee and trading costs which is 0.80%. Returns reflect since inception, one, five and ten‐year periods, and are reflected in U.S. dollars and assume that dividends are reinvested.

The strategies employed may involve technical trading techniques such as trend analysis, relative strength, moving averages, various momentum and related strategies. Technical trading models utilize mathematical algorithms to attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, new data is accurately incorporated, or the software can accurately predict future market, industry and sector performance.